403b early withdrawal calculator

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. 403 b plans are only available for employees of certain non-profit tax-exempt organizations.

401 K Early Withdrawal Guide Forbes Advisor

For example if you fall in the 10 percent bracket a 2000 distribution.

. Retirement Withdrawal Calculator Terms and Definitions. The money counts as ordinary income so the higher your other income the higher the tax rate on your 403 b withdrawal. Amount You Expected to Withdraw This is the budgeted.

Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k. The 403b was created as a tax deferred retirement plan in the US. Expected Retirement Age This is the age at which you plan to retire.

Using this 401k early withdrawal calculator is easy. If you are under 59 12 you may also be. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation.

There is no 20 mandatory federal tax withholding required at the time of distribution. Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. Calculate your earnings and more.

If you are under 59 12 you may also. And from then on. However it requires you to take equal periodic payments for a minimum of 5 years or.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax. There is a penalty for 403b early withdrawal.

501c 3 Corps including colleges universities schools. If you are under 59 12 you may also be. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate.

Withdrawals will be taxed based on whether you originally. Generally the amounts an individual withdraws from an IRA or retirement plan before. The 10 early withdrawal penalty is waived.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement.

If you are under 59 12 you may also. Generally if a person is. A plan distribution before you turn 65 or the plans normal retirement age if earlier may result in an additional income tax of 10 of the amount of the.

Rule 72 t This rule gives you the ability to take early 403 b withdrawals at any point without a penalty. Last Modified Date. If you take money out of your 403 b plan prior to turning 59 ½ years old you must pay an additional 10 percent tax penalty on top of the ordinary income taxes which is the same.

401 K Vs 403 B Vs 457 Plans Compare Employer Sponsored Retirement Plans Mybanktracker

Utilizing The U S China Tax Treaty To Avoid U S Withholding Tax And Early Withdrawal Penalties From A 403 B Plan Sf Tax Counsel

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

The Cost Of Cashing Out Retirement Plans Early Equitable

12 Ways To Avoid The Ira Early Withdrawal Penalty

Withdrawing Money From An Annuity How To Avoid Penalties

How To Use The Rule Of 55 To Take Early 401 K Withdrawals

Should You Make Early 401 K Withdrawals Due

Roth Ira Vs 403b Which Is Better 2022

401 K Hardship Withdrawal Rules 2022 Ubiquity

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

403 B Definition Pros Cons Seeking Alpha

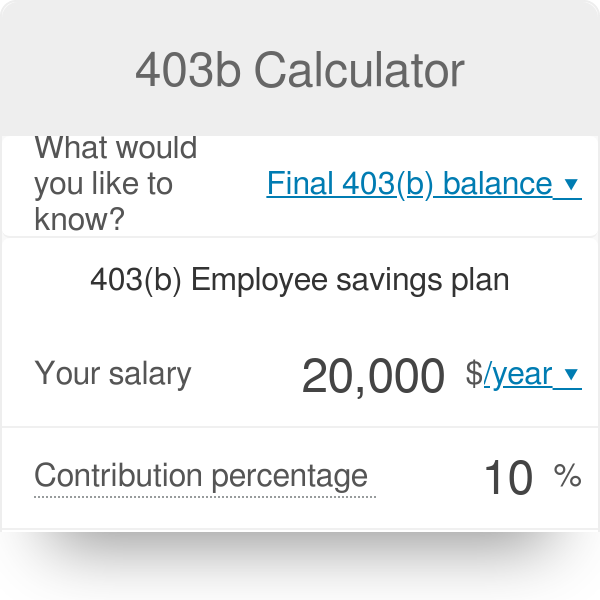

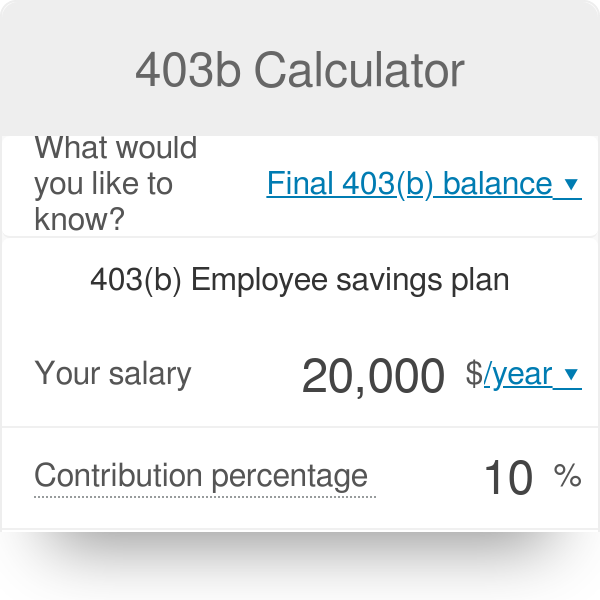

403b Calculator

401 A Vs 403 B What You Need To Know Smartasset

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Retirement Plan Withdrawal Calculator Financialfrontline Org

Financial Calculators